Over the last two years we’ve seen some impressive investment announcements in the Canadian automotive industry the size of which we’ve literally never seen before.

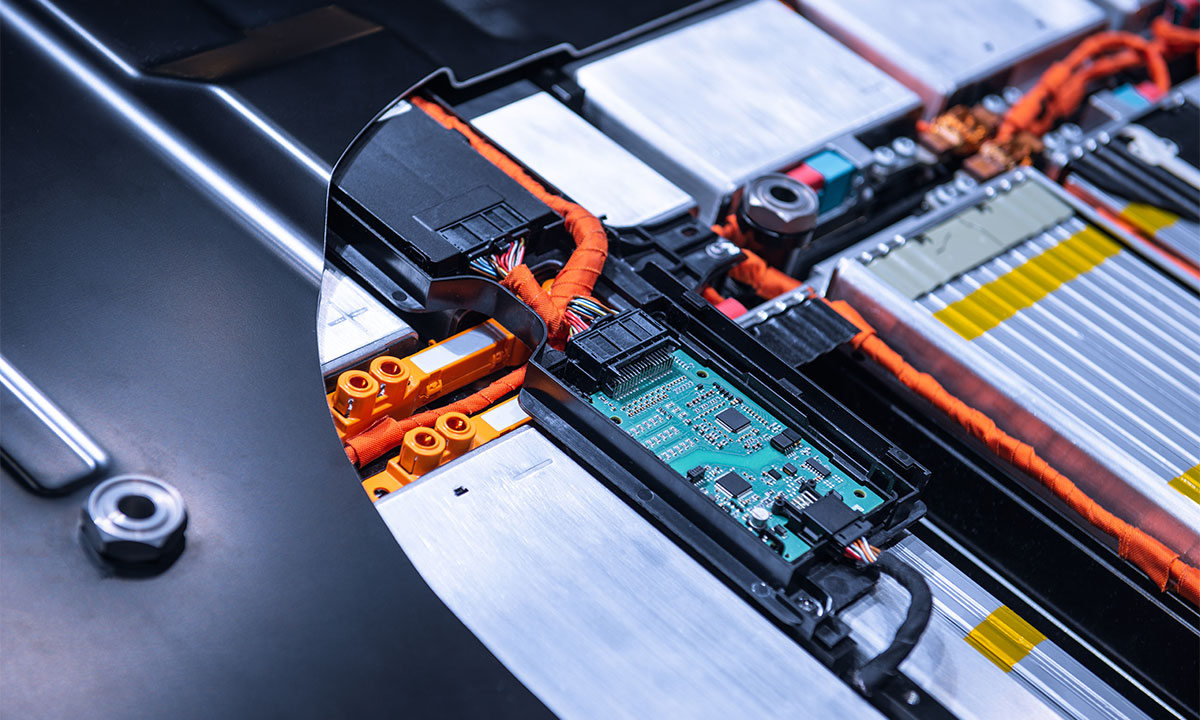

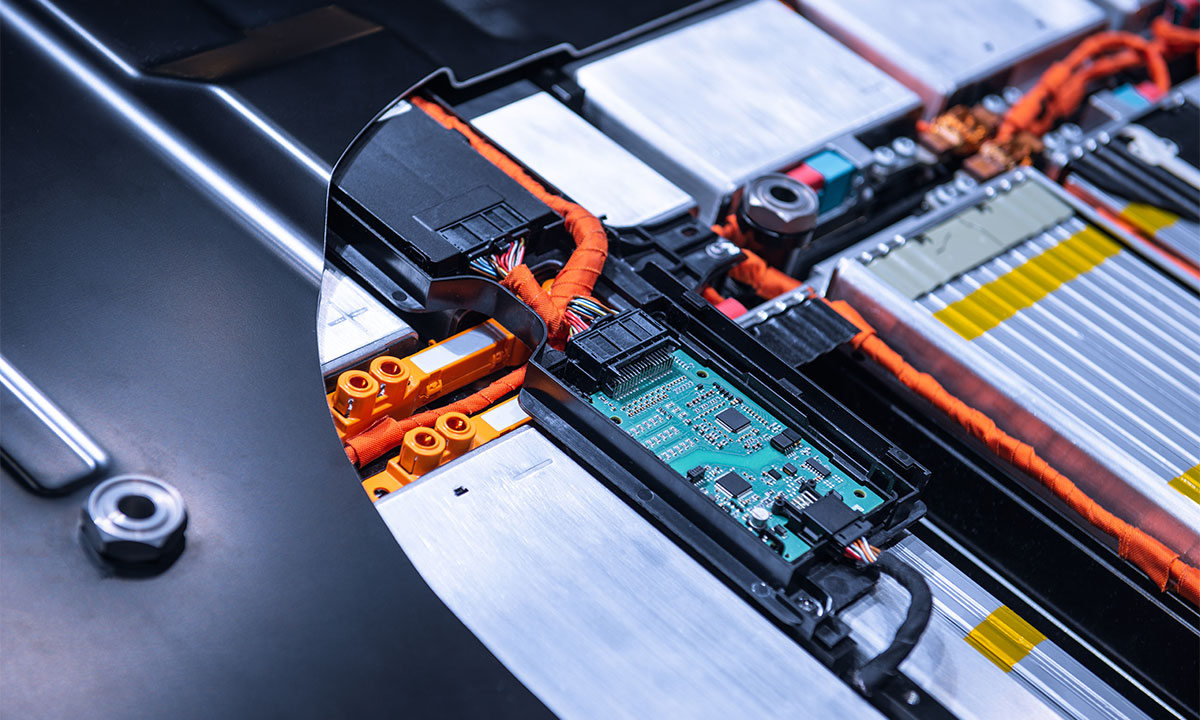

These investments are not just in the vehicle manufacturing sector but also in the supplier sector, and, in particular, in the battery supply and battery components sectors. Indeed, the two largest investments in Canadian automotive history (at the time of this writing!) are two battery plant facilities, one announced by Stellantis last March for the Windsor area and the other just recently announced on March 13, 2023 by Volkswagen Group.

While we don’t yet know the size of the overall investment of the Volkswagen battery manufacturing facility in St. Thomas, nor how many people it will employ, nor the government assistance provided from both levels of government to secure the investment; we do have some guidance.

The VW plant has been touted by Industry Minister François-Philippe Champagne as being the largest automotive investment in Canadian history, which obviously makes it bigger than the $5 billion invested by Stellantis.

We can also reasonably assume that if it is a bigger facility it will employ more than the 2,500 people that the Stellantis plant will employ. What will be really interesting to find out is how much both the federal and Ontario governments invested to land both the Stellantis battery plant and the Volkswagen battery plant.

We don’t know the numbers in either case at this point because they are deemed to be commercially sensitive as the two governments continue to work with other battery suppliers to try and land additional gigafactories in Canada.

Traditionally, however, both governments have typically partnered with about 25 per cent of the overall investment made by a vehicle manufacturer. In recent rounds of investment that number has trended higher with both levels of government contributing more than one-third of the $3.6 billion announcement made last May to transform Stellantis’ Windsor and Brampton assembly plants.

With respect to both the Stellantis battery plant and the newly announced VW battery plant, I think it is probably fair to say that the level of government investment in both of those facilities will be much, much higher than 30 per cent of the capital expenditure for each of those investments.

There are at least a few reasons why this is the case. The first reason is that there is global competition for these generational investments in battery plants to produce the batteries that will drive the electric vehicles of not only the present but the future.

These investments are landing plants that will likely be in operation anywhere from 3—50 years into the future, but there will only be so many of them while this current investment frenzy is underway to build out the new propulsion supply chain.

If we get a little closer to home and look at North America, things have become incredibly complicated and skewed towards the United States as far as any type of cleantech investment is concerned by virtue of new NAFTA (CUSMA/USMCA) and the Inflation Reduction Act.

The CUSMA (in Canada!) requires that 75 per cent of the value of the battery (as of July 1, 2023) has to be from the North American region for EVs entering the United States to secure duty-free access. Otherwise, a 2.5 per cent tariff would apply.

Under the Inflation Reduction Act that was signed into law by President Biden last August, things became more complicated on two fronts, one, originally only batteries and battery parts sourced in the United States were going to qualify for the $7,500 consumer incentive to purchase an EV.

This incentive consisted of two pieces, one, a $3,750 chunk which was applicable to critical minerals coming from the United States and the second $3,750 chunk which was applicable to the value of the batteries components.

In the first instance, in order to secure that chunk of the incentive, at least 40 per cent of the critical minerals had to come from the U.S. rising to 80 per cent in 2027.

In the second instance, at least 50 per cent of the value of the battery components had to come from the U.S. rising to 100 per cent in 2029.

Canadian industry and the Canadian government applied a full-court press to push the U.S. to include Canada and other countries with whom the U.S. has a free trade agreement under those definitions to ensure that EVs that will eventually be built in Canada, would be eligible for the EV tax credit.

If not, Canadian built EVs would have been at a $7,500 cost disadvantage in the U.S. market, which is essentially impossible to overcome. Given that Canadian plants export 85 per cent or more of their production to the United States, many called these provisions—if left in their original form—an existential threat to the Canadian automotive industry.

With that situation addressed, the other provisions of the IRA that flew under the radar were the production tax credits, investment tax credits and operational tax credits contained within the IRA resulting in incentives worth $35/kwh for battery cells, $10/kwh for battery modules ($45/kwh overall) along with 10 per cent of the production costs for battery components and 10 per cent of the cost of production for critical minerals.

All of these incentives combined resulted in orders of magnitude more government support being offered in the United States vis-à-vis Canada for these investments.

Dr. Bentley Allan of the Transition Accelerator and Michael Bernstein from Clean Prosperity have estimated that the federal and state support for a typical 45 GWh/year battery plant was in the order of $48.41/kWh versus $2.36/kwh in federal and provincial grants in Ontario, meaning that there is a $2 B difference between what Canada is currently offering compared to the U.S.

This difference is sizeable and it is why the federal government acted in the recent Federal budget to address—in a targeted way these differences to ensure that Canada could still be in the game in securing additional investments.

Make no mistake though. The IRA subsidies are sizeable but it is only one piece of the puzzle. Access to a talent pool, access to market, access to renewable electricity, access to an automotive supply ecosystem, a stable and reliable political structure all likely factored into Volkswagen’s decision.

At some point we will know the quantum of the government support for the Stellantis and the VW battery plants but that support—whatever it is—will be worth it to lock down high paying jobs for a generation not only in the facilities themselves but in suppliers etc with an estimated multiplier effect of about eight for each job in the manufacturing facility.

Landing Volkswagen is key for Canada however, in that it is the first new automaker to set up shop in Canada since the late 1980s which sends a strong signal to the world that Canada has what it takes to be a major player in the electrified future moving forward.